The Business Pass Guarding Against Expense Report Fraud

Mis-Characterized Expenses

Employees categorize personal expenses as business-related, often challenging to detect from the submitted receipts alone

Fictitious Expenses

Fraudulent claims feature bogus receipts, either computer-generated or handwritten, closely resembling genuine receipts and easily accessible from local printers

Overstated Expenses

Employees inflate the cost of legitimate expenses, often by altering handwritten amounts or exaggerating tips, leading to financial discrepancies.

Multiple Reimbursements

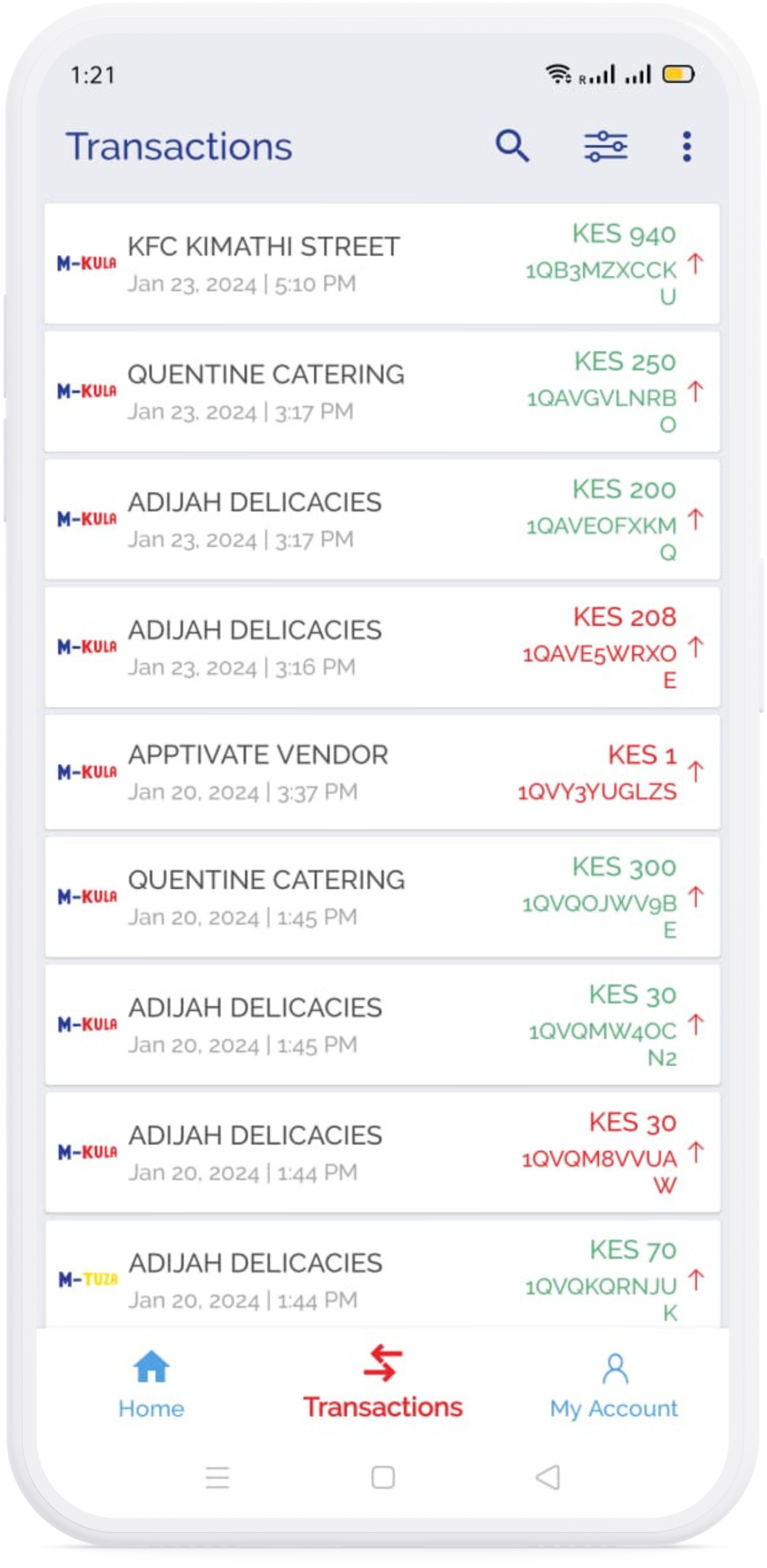

Employees submit the same receipt multiple times, potentially leading to duplicate payments if not rigorously scrutinized by the finance team, such as combining expenses from one bill into another

Did You Know

40% of employees will submit an incorrect expense report. Expense reports for values over Ksh 50,000 are exaggerated by 14% on average. Expense reports for values less than Ksh 50,000 are exaggerated by an average of 22% on average.

Learn moreAny questions? Check out the FAQ

Please fill in this form and we shall get in touch with you.

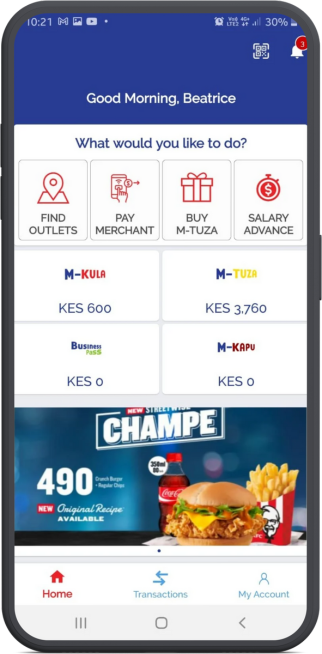

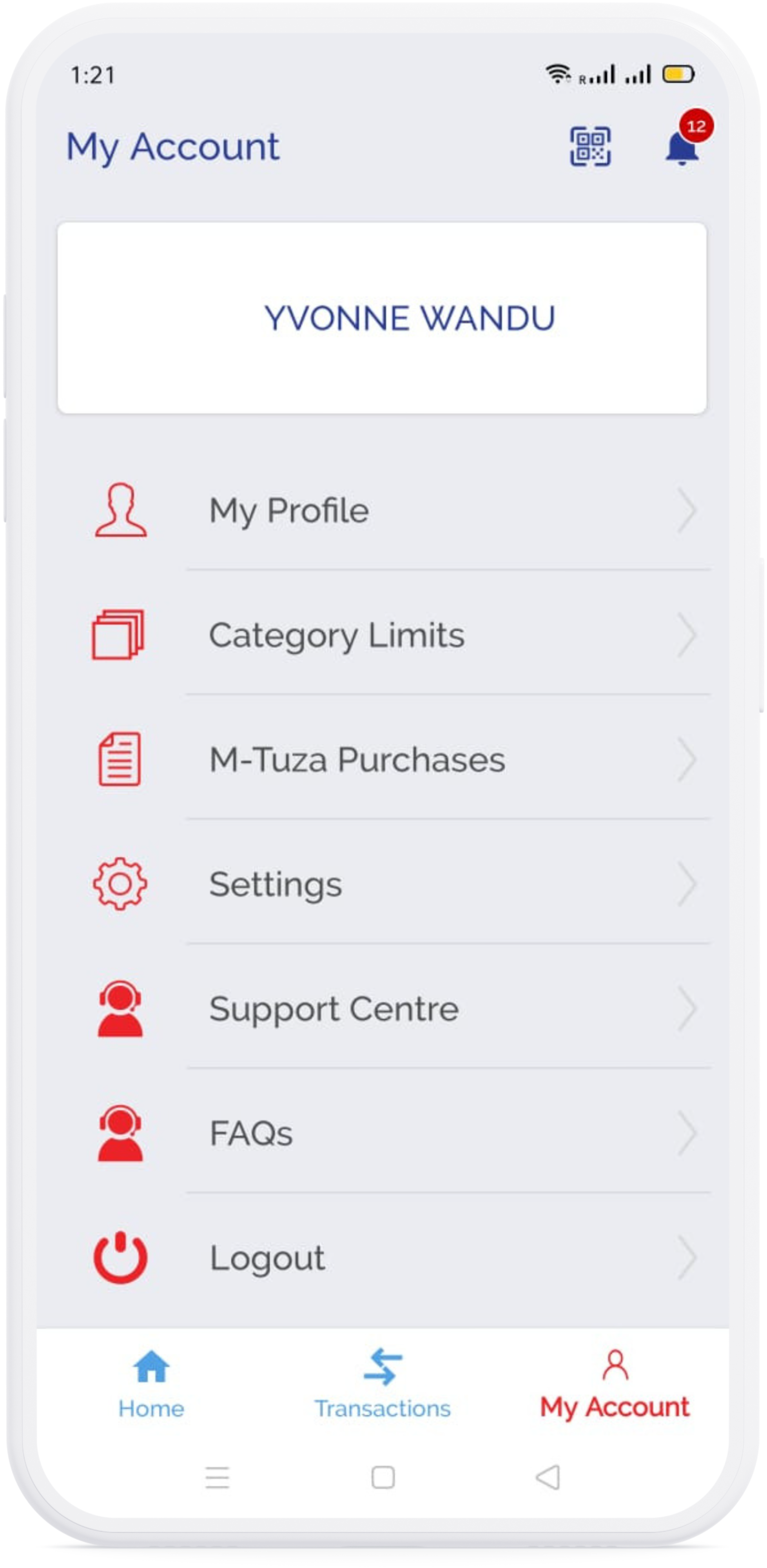

Please use this tutorial for detailed guidance on the same.

Please use this tutorial for detailed guidance on the same.

Please use this tutorial for detailed guidance on the same.

After placing and authorizing an order, you will receive an ETR copy of your invoice via mail.

Yes. The voucher has a validity of 6 months after expiry.

Enquire Now

Simplify Expense Management with The Business Pass today."