M-Kula: Feeding Innovation, One Byte at a Time

Enhancing Workplace Wellness for Better Productivity and Happiness

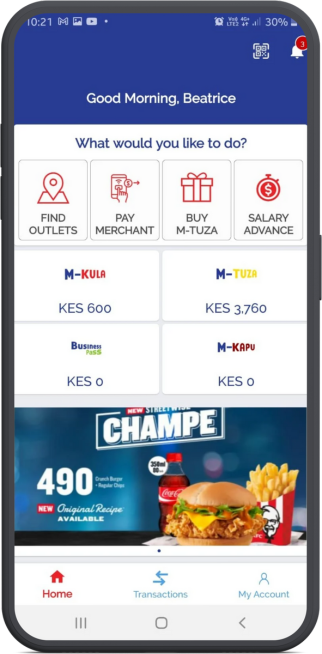

Financial constraints lead many blue-collar workers to skip lunch, impacting productivity, while providing balanced and nutritious meals through M-KULA enhances productivity, profitability, and supports employee health, motivation, efficiency, and long-term goals.

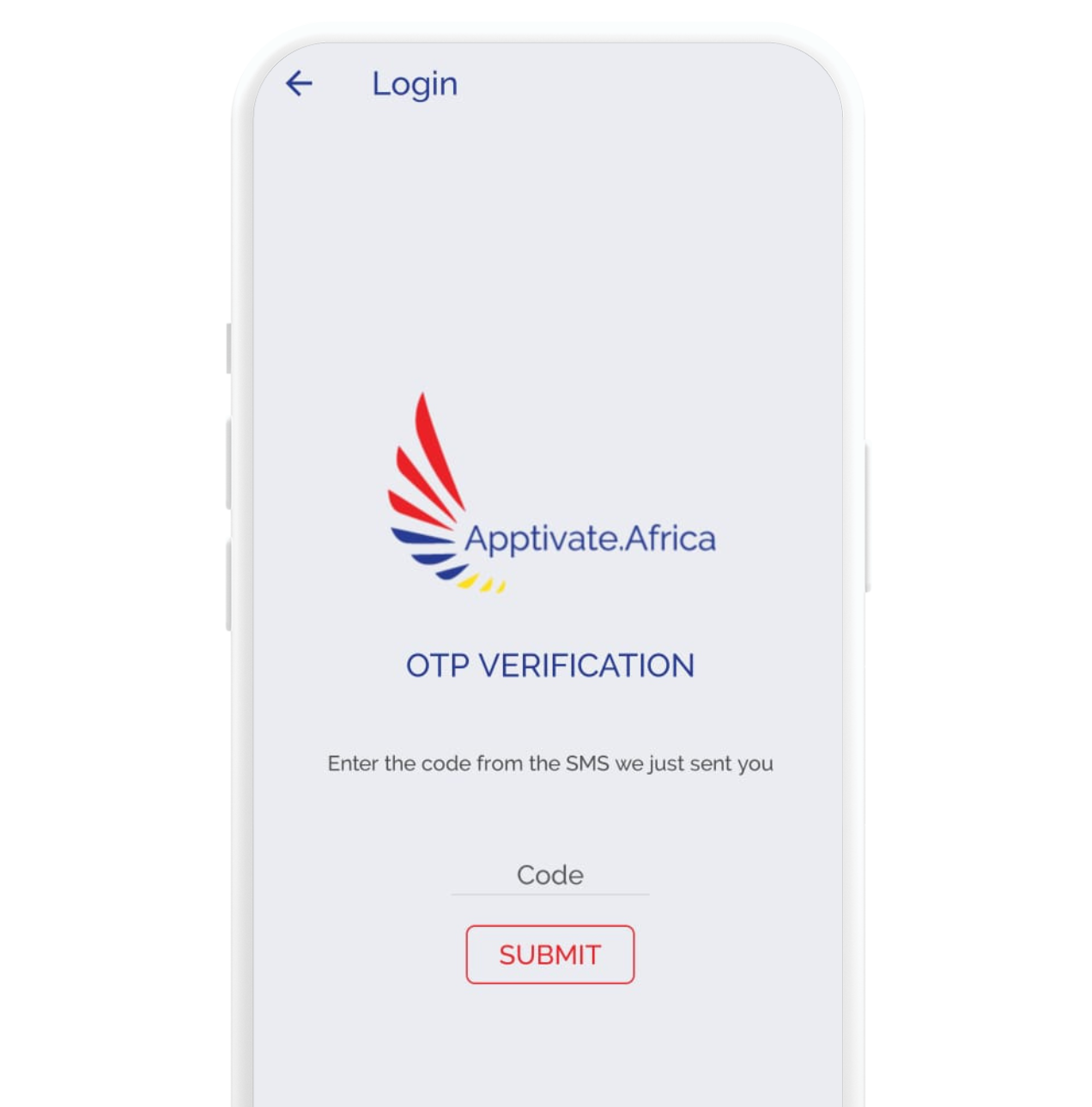

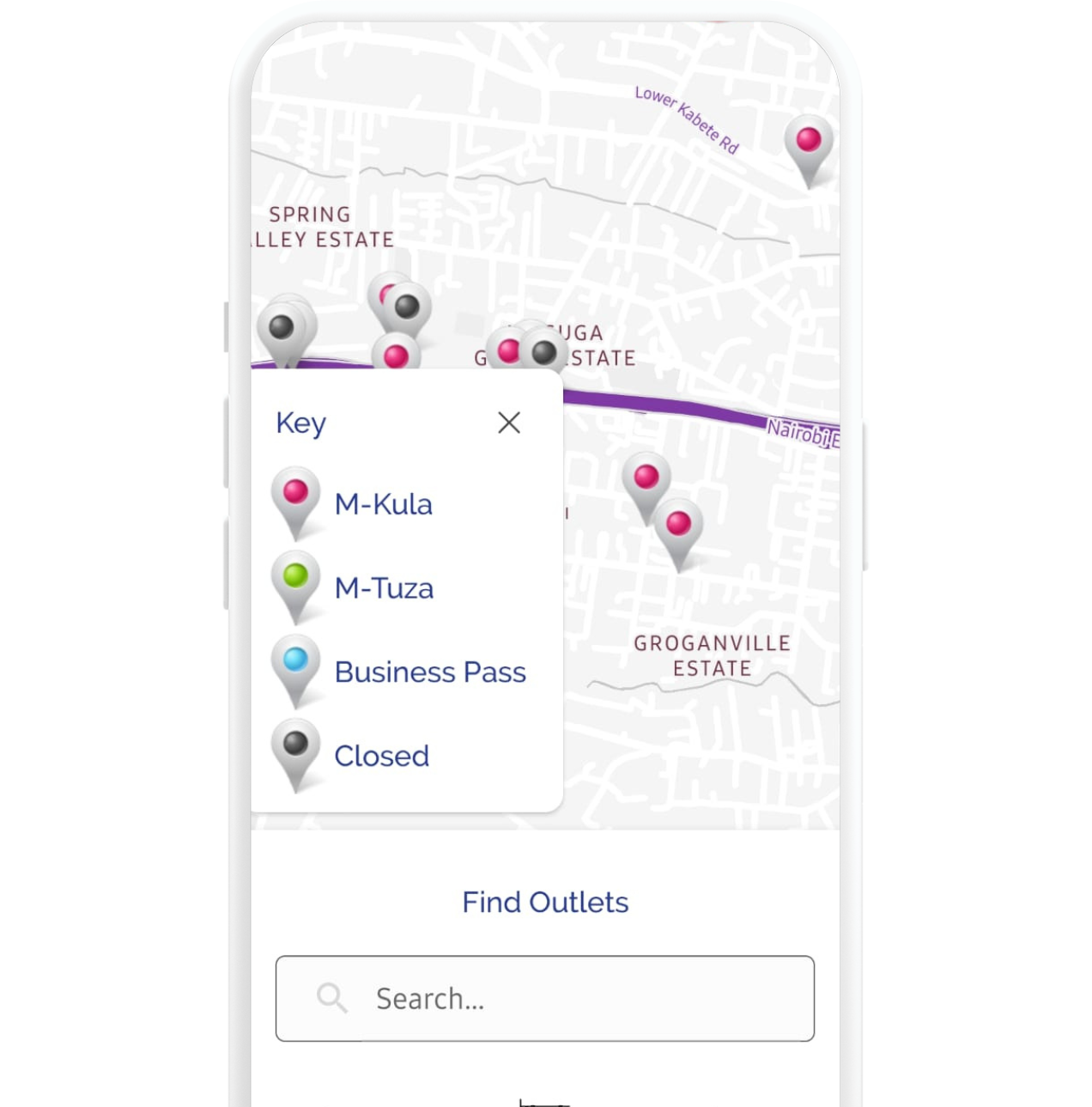

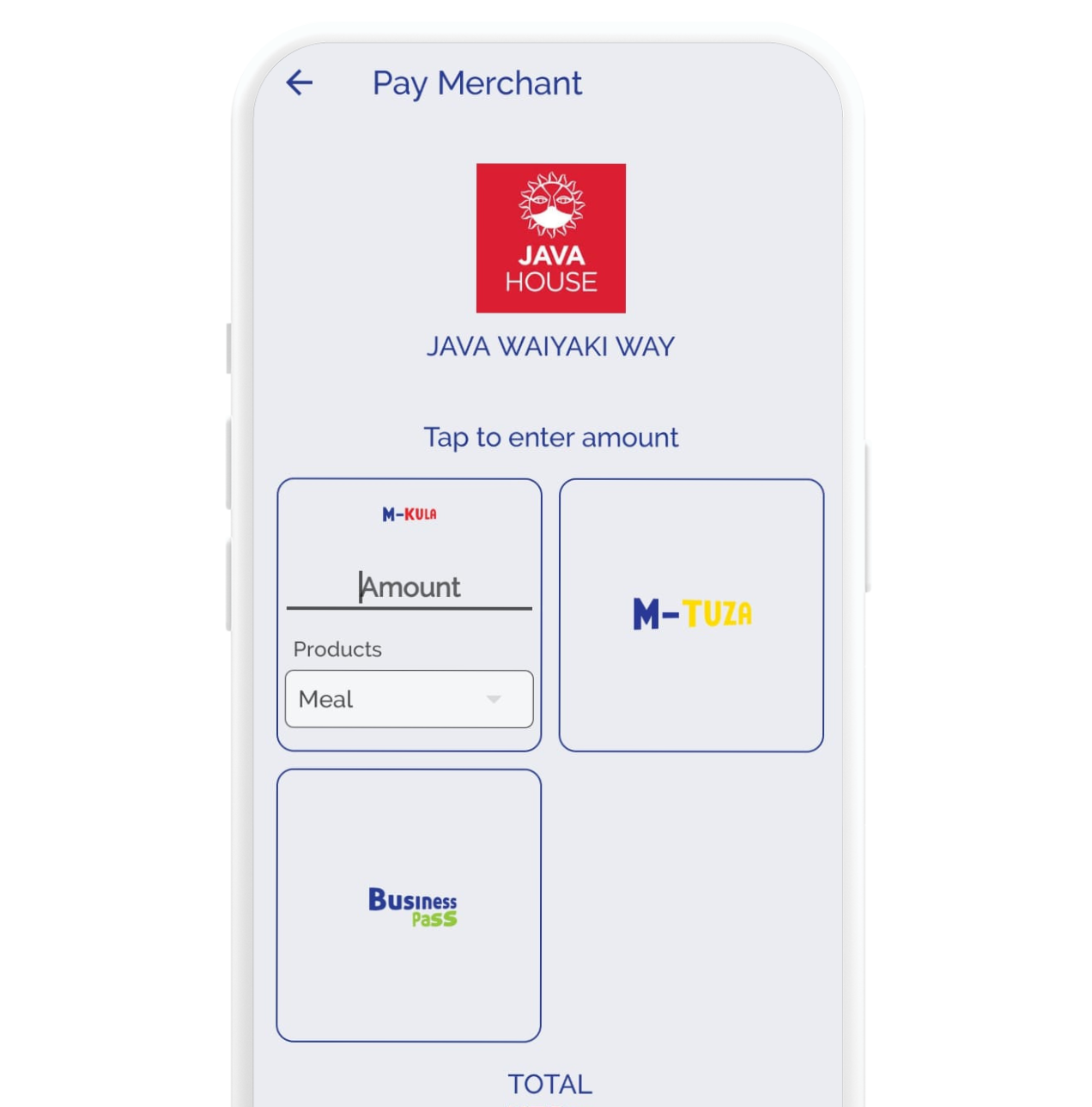

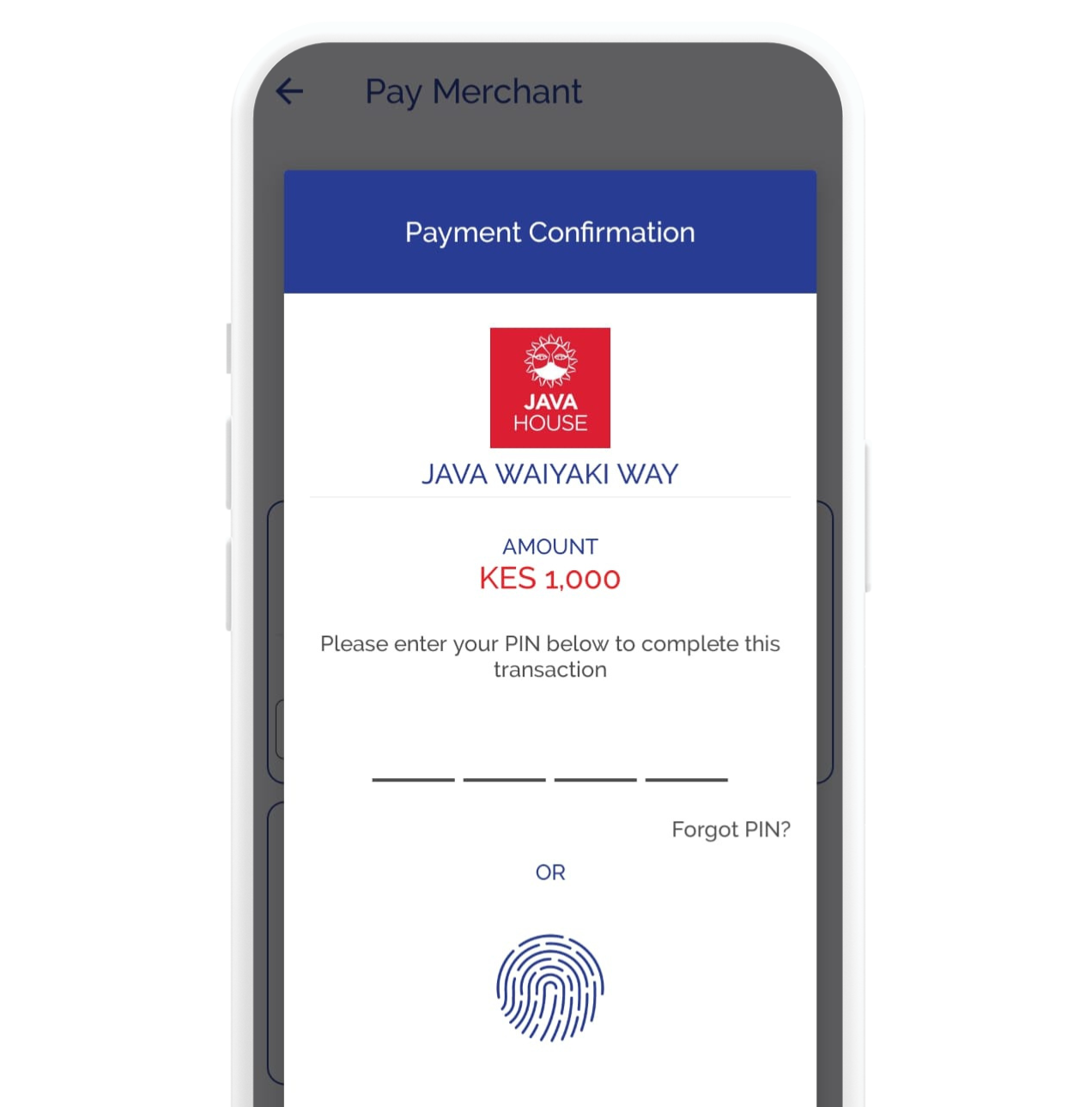

Innovative & Safe Technology

Our platform ensures continuous security and operational reliability through multiple layers of security, trusted service providers, and robust redundancies, resulting in a remarkable 99.72% uptime over the past two years.

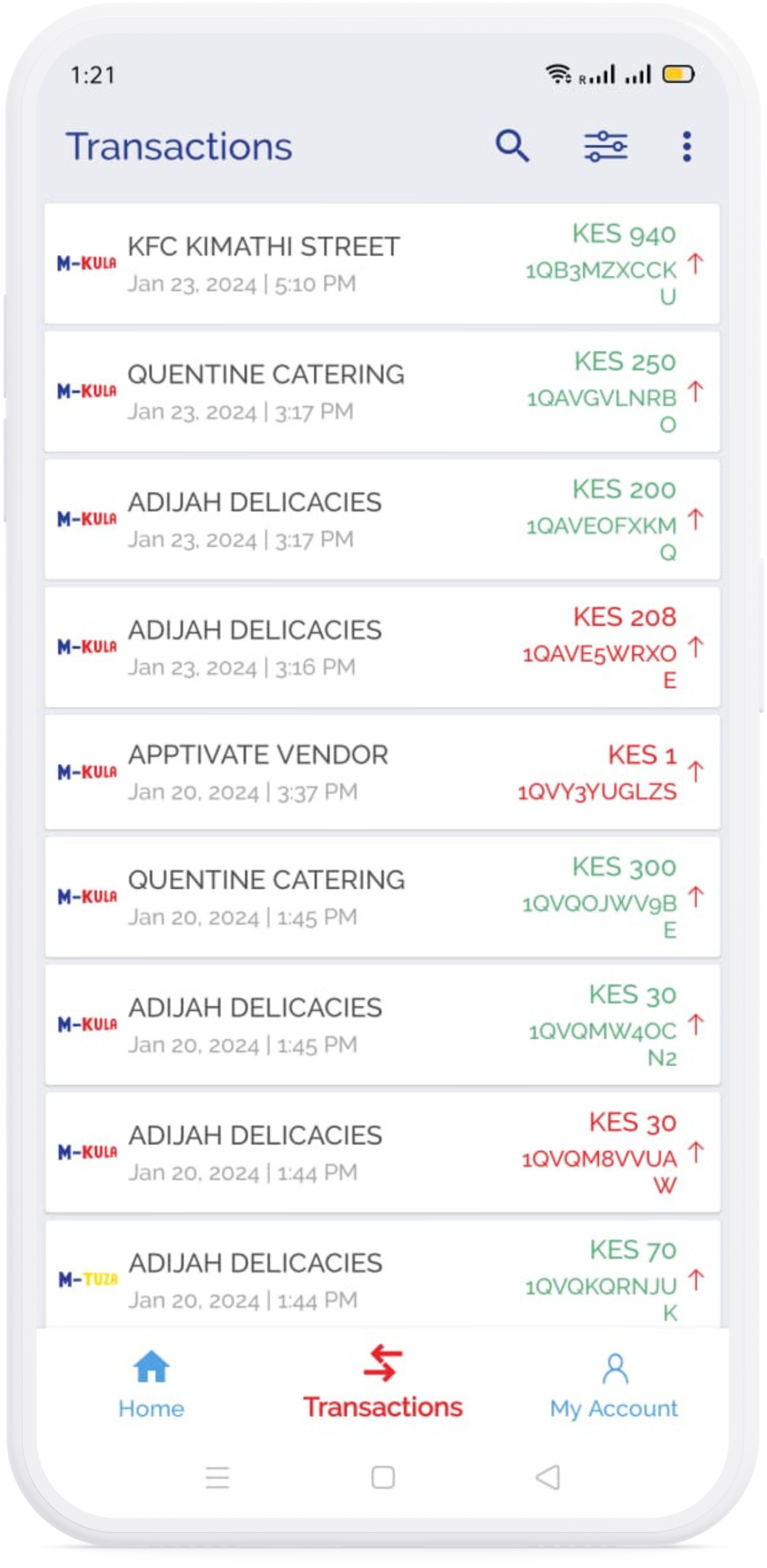

No Reconciliation with Caters

M-KULA simplifies meal tracking, preempting disputes between caterers and stakeholders over consumption, thus optimizing efficiency by minimizing time spent on dispute resolution.

Budget Friendly

M-KULA offers tax-exempt meal solutions in Kenya and Uganda, allowing employers to offset expenses against tax liabilities and providing employees with customizable daily spending limits for effective budgeting.

Testimonials from Clients who recommend M-Kula

Any questions? Check out the FAQ

Please fill in this form and we shall get in touch with you.

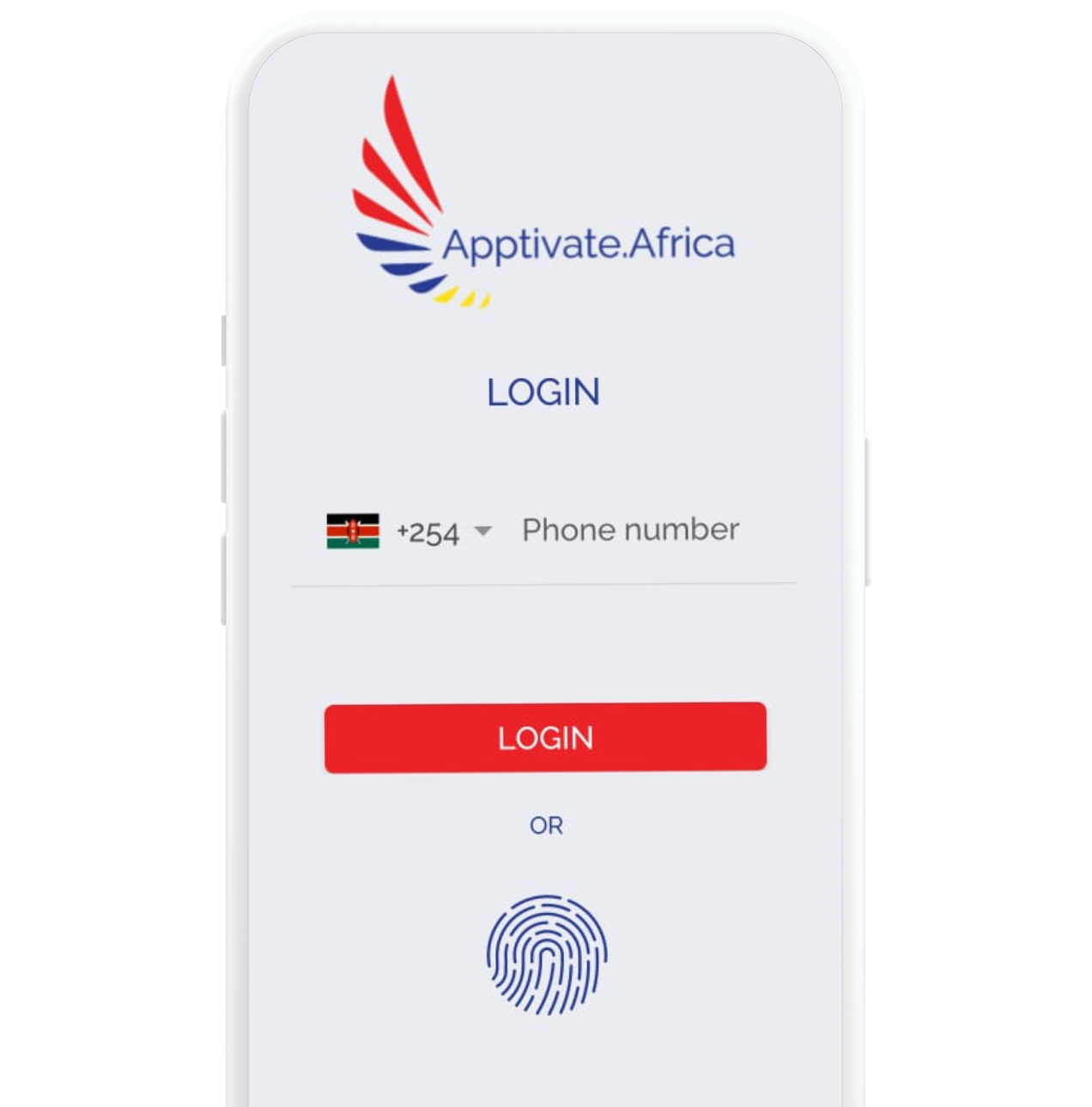

Please use this tutorial for detailed guidance on the same.

Please use this tutorial for detailed guidance on the same.

Please use this tutorial for detailed guidance on the same.

After placing and authorizing an order, you will receive an ETR copy of your invoice via mail.

Yes. The voucher has a validity of 6 months after expiry.

Enquire Now

Experience the difference with M-Kula today."